Advancing Tax Fairness

While BCREA welcomes the PTT exemption for newly-built principal residences up to $750,000, the Association had hoped the provincial government would provide relief to a greater number of real estate consumers.

The new third tier of 3% over $2 million was implemented to pay for the new home exemption. Unfortunately, the government has decided not to index the new threshold. That means, as prices rise, an increasing number of properties will be subject to the new tier. This is exactly the approach that has turned BC's PTT into the highest provincial transfer tax in Canada, and placed a significant burden on property buyers.

Since the PTT was introduced in 1987, BCREA has lobbied the government to either eliminate the tax or minimize its negative impact. Those efforts will continue this spring with BCREA's provincial lobbying conference.

Government Liaison Days will take place April 24-26 in Victoria. This annual event is a key provincial advocacy opportunity for organized real estate, during which REALTORS® from around the province meet with MLAs for focused discussions.

This year, those meetings will revolve around the following recommendations to improve tax fairness for British Columbians:

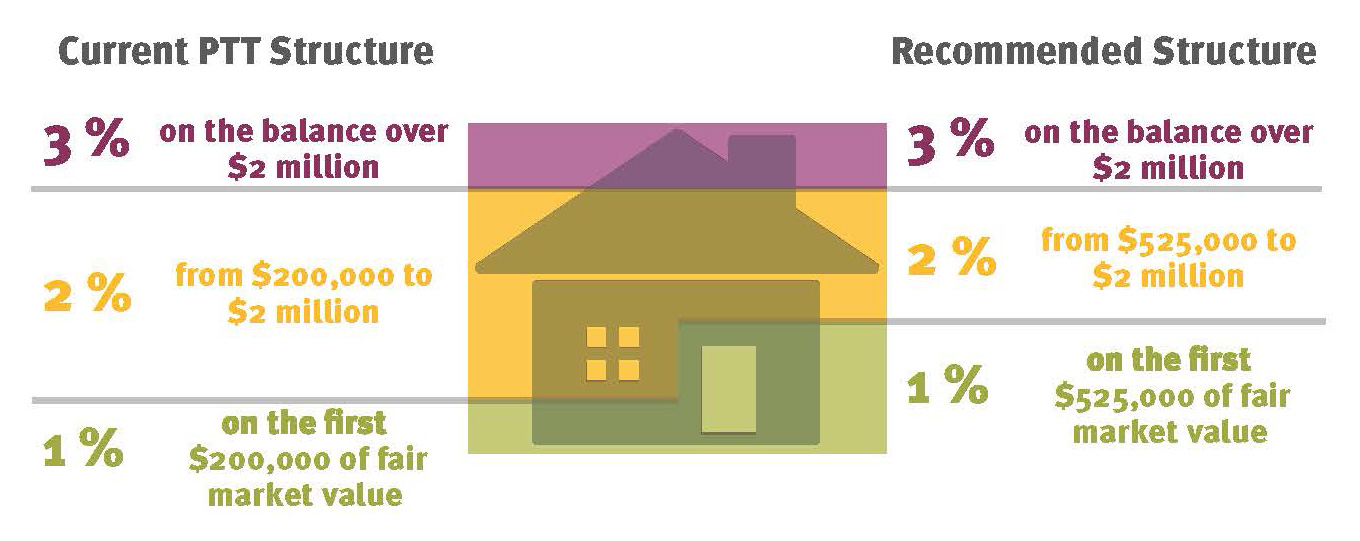

- Increase the 2% PTT threshold from $200,000 to $525,000.

- Index the following PTT thresholds using the MLS® Home Price Index, and make adjustments annually:

o 2% and 3% thresholds,

o First-Time Home Buyers' Program exemption threshold, and

o Newly Built Home Exemption threshold. - Respecting privacy legislation and practice, publish buyers' residency data and the government's analysis of that data.